Summary

Unless the Irish government commits to more aggressive action and higher spending on the energy transition, Ireland is almost certainly going to miss our legally binding EU commitments by a wide margin and end up with a bill of many billions (maybe tens of billions) of euros. Conversely, committing to these investments would save the country money (even ignoring fines) as well as creating the societal benefits of a low-carbon economy.

Ciara Doherty and Prof. Hannah Daly have published an Analysis of the alignment between energy transition pathways for Irish carbon budgets with EU energy and climate targets ..

I know from the most recent episode of the Hot Mess that things were looking bad, but this report does a great job of getting into the details with one big caveat: it “excludes agriculture and land use, land use change and forestry” (LULUCF) because they are not covered by models used. This is unfortunate because agriculture is clearly the elephant in the room when the report discusses our large predicted misses that will result in tens of billions of euros of future costs. The authors call this out as shortcoming and an area for future work.

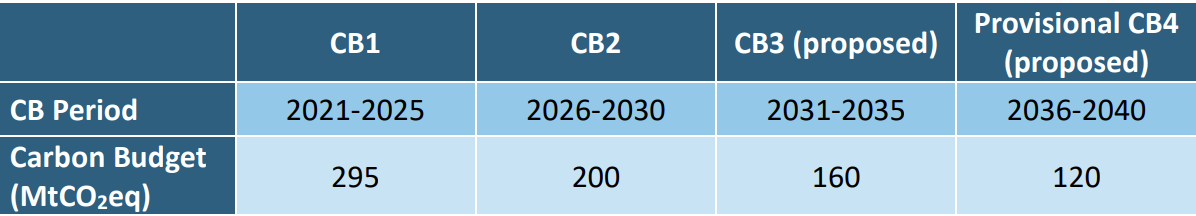

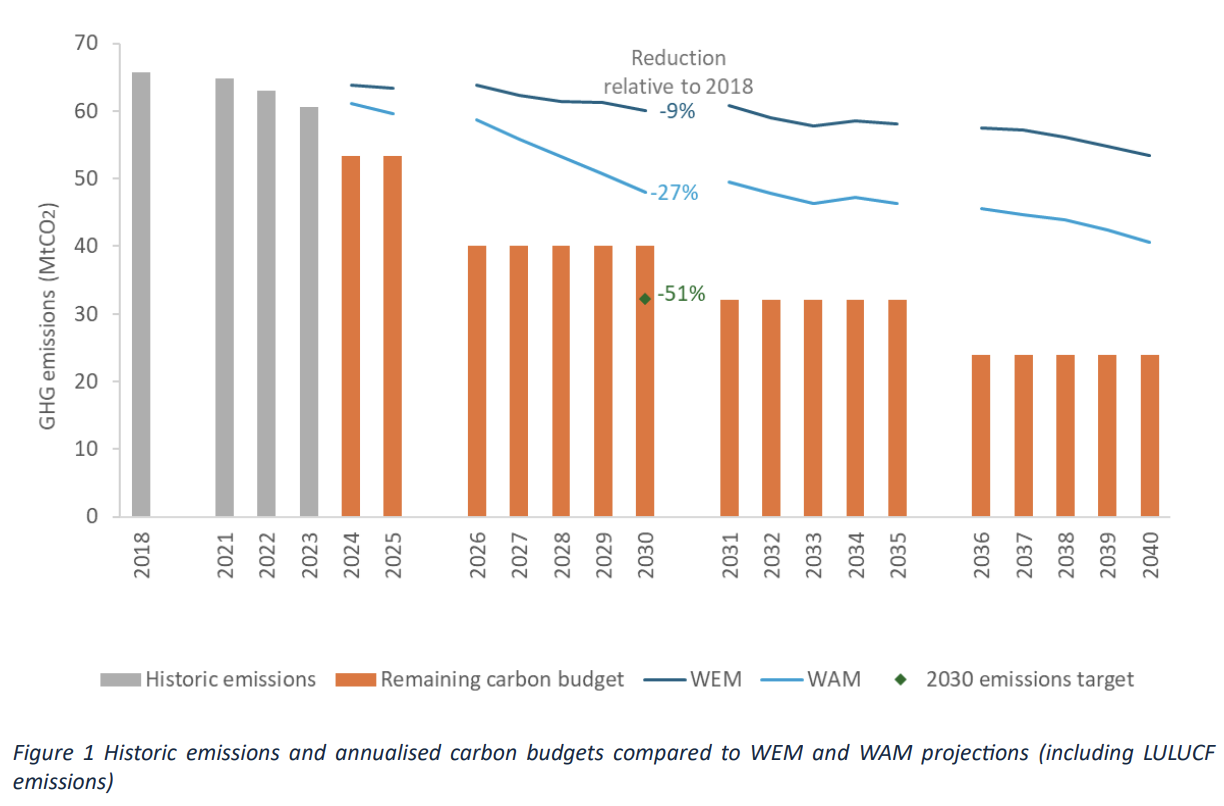

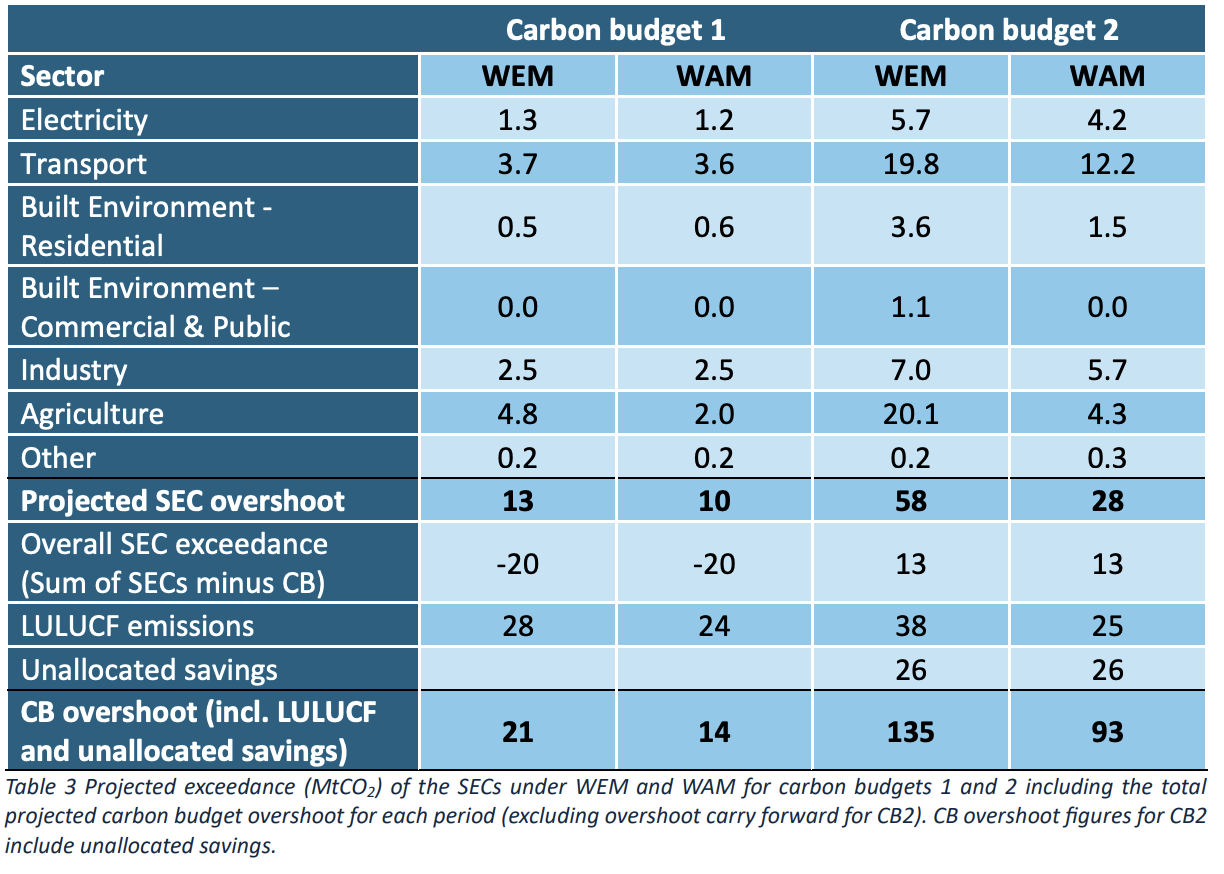

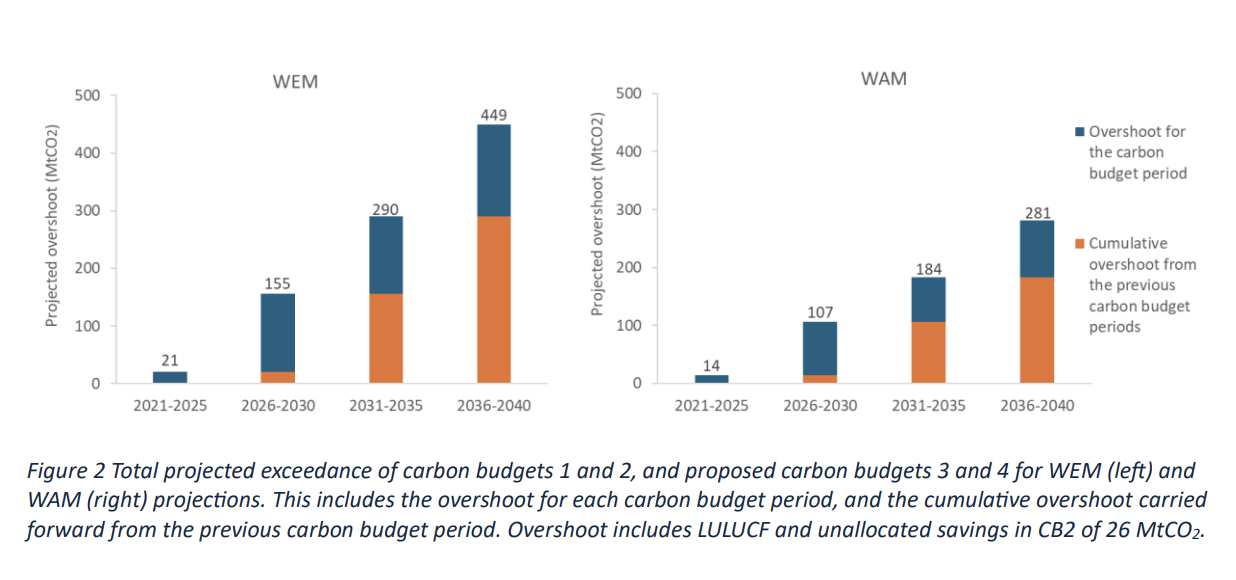

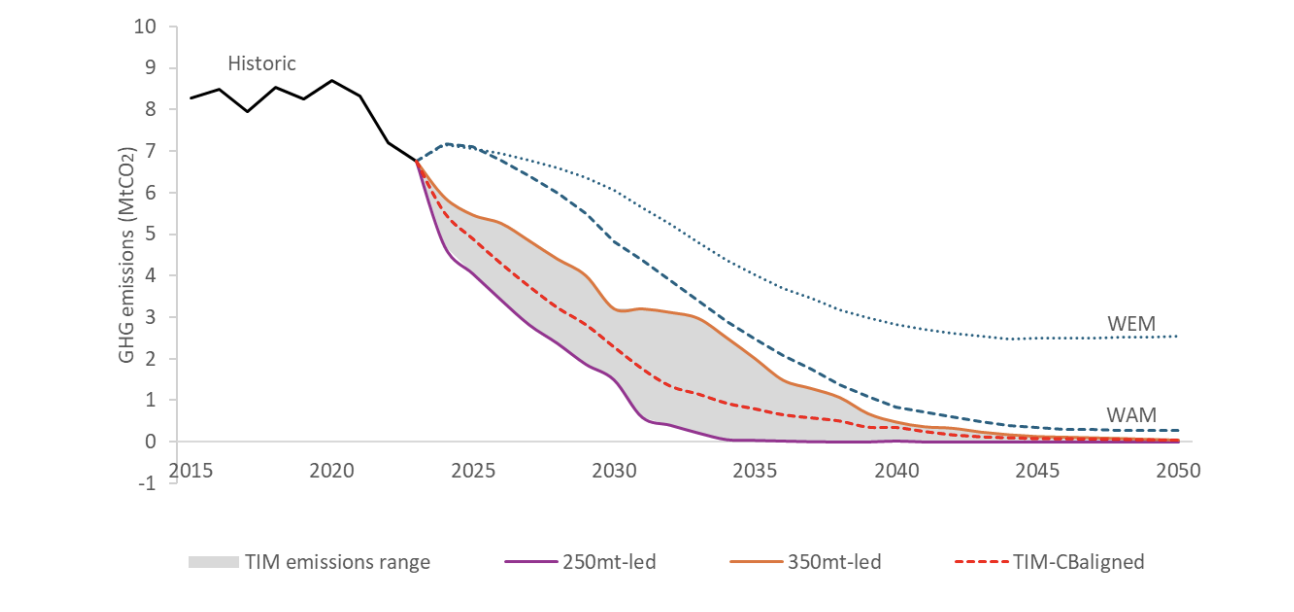

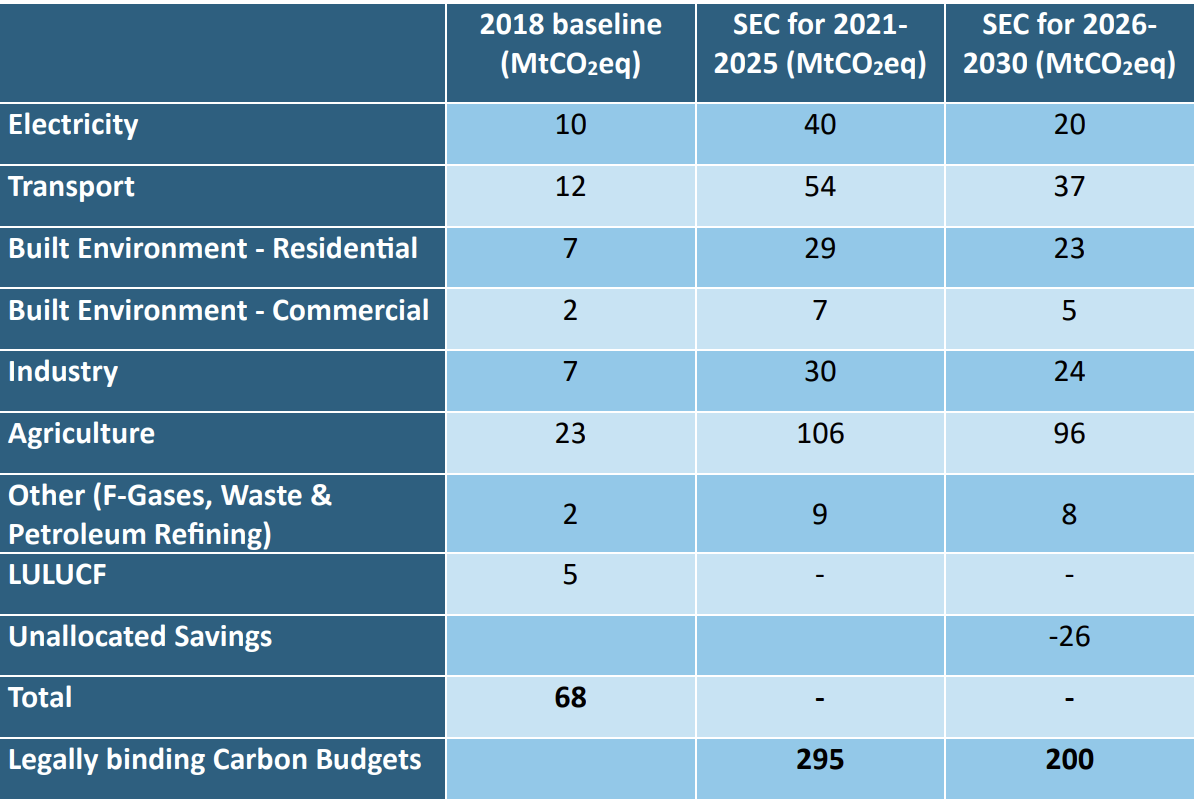

The report looks at several energy system scenarios based on the proposed carbon budgets by the Climate Change Advisory Council (CCAC who are required by the 2021 Climate Act to provide recommendations for carbon budgets to Government) as well as the EPA’s “With Existing Measures” (WEM) and “With Additional Measures (WAM) scenarios” which are based on current and planned government actions. These scenarios are then evaluated against the various EU commitments and the national carbon budgets (CBs) and per-sector budgets (Sectorial Emissions Ceilings, SECs). CBs and SECs are supposed to be what get us to meet our EU commitments.

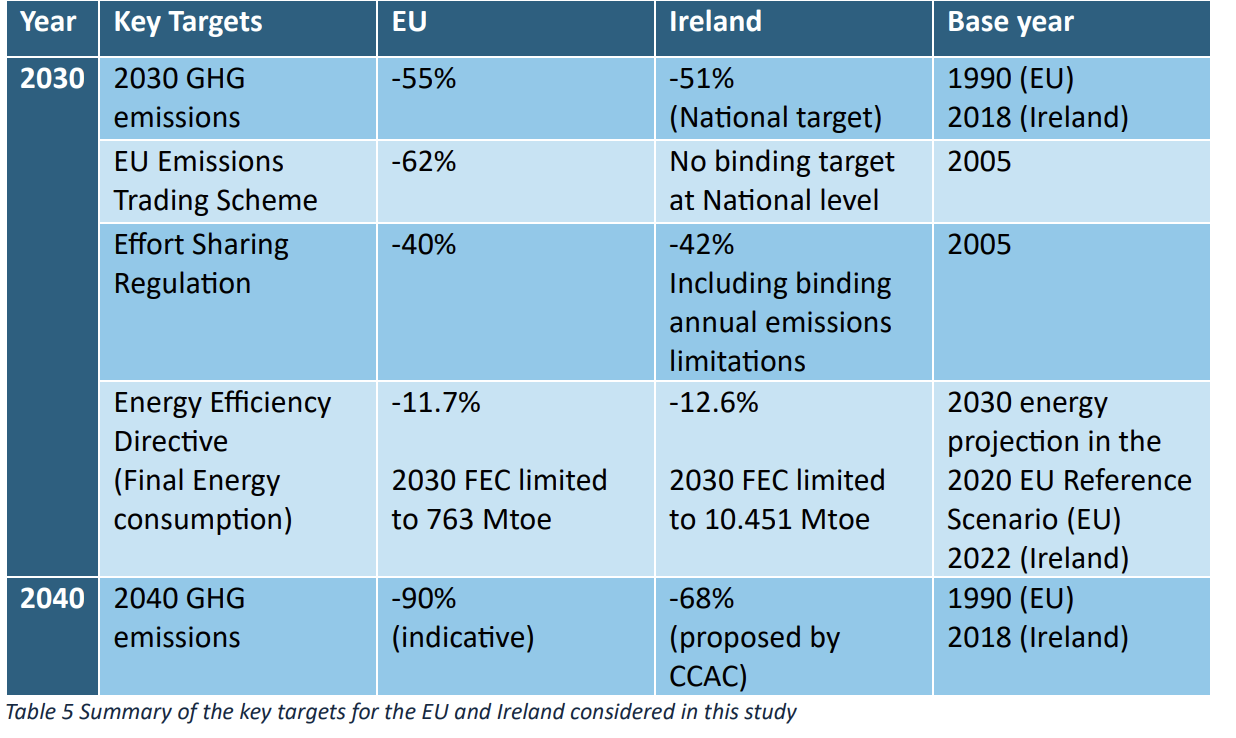

What are these complicated EU requirements? Well there are four categories, some are binding, some are not. They cover different sectors (power, agriculture, industry, transport etc). Some are EU-level, some are national and some are tradable and possibly (it seems undecided), some may be offsetable against other categories. This table shows some of the complexity but does not cover all dimensions (where’s my policy hypercube?):

How are we doing?

Not great. In fact, we’re way off track for almost all targets.

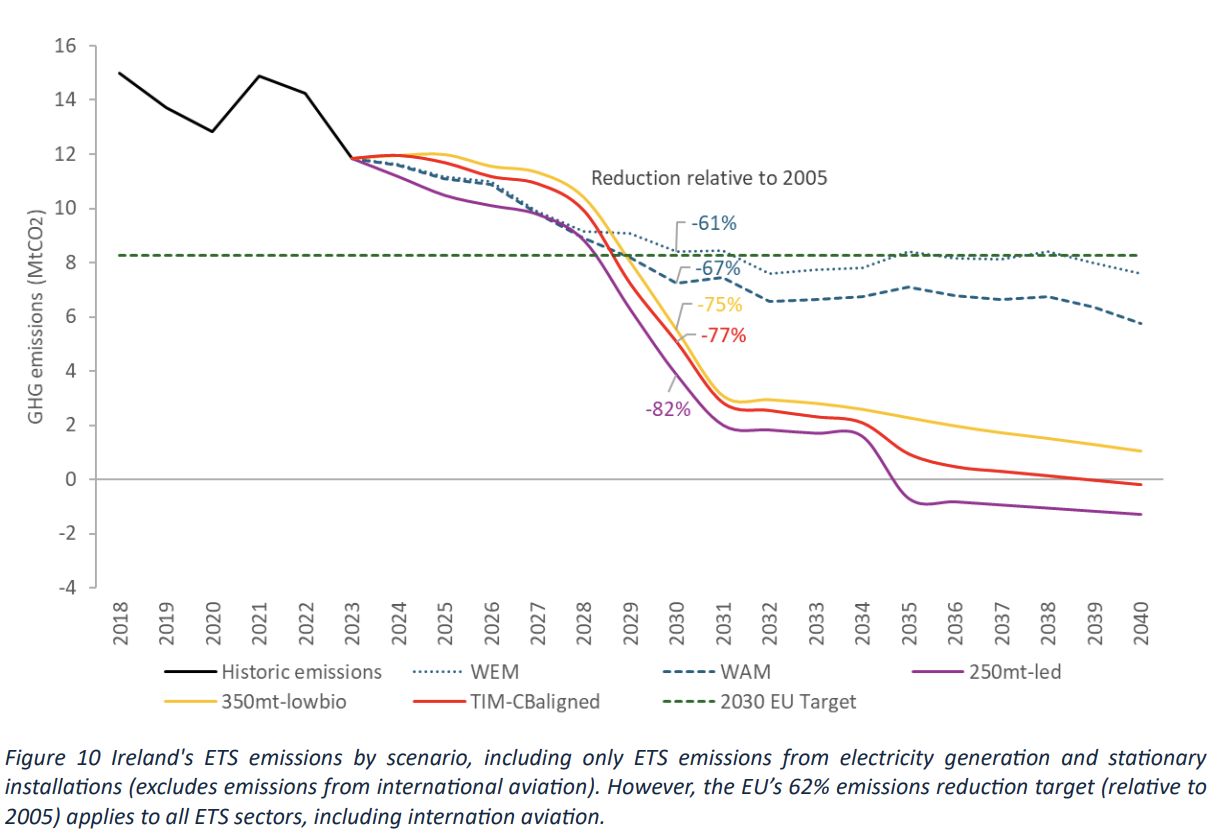

Emission Trading Scheme (ETS): A cap and trade per-sector system that includes electricity and heat production, large scale industrial manufacturing, and intra-EU aviation. No fines, but entities (companies?) have to pay for credits.

This is the brightest spot for Ireland, largely due to it not including agriculture or transport, and our lack of heavy industry and reasonable amount of renewable power generation. In all energy system scenarios we meet this target thanks mostly to large expected drops in GHG emissions from the power sector and industry. And in all but the worst (WEM) we have enough left over to transfer 4% of our ETS allowance to help with the next target, ESR.

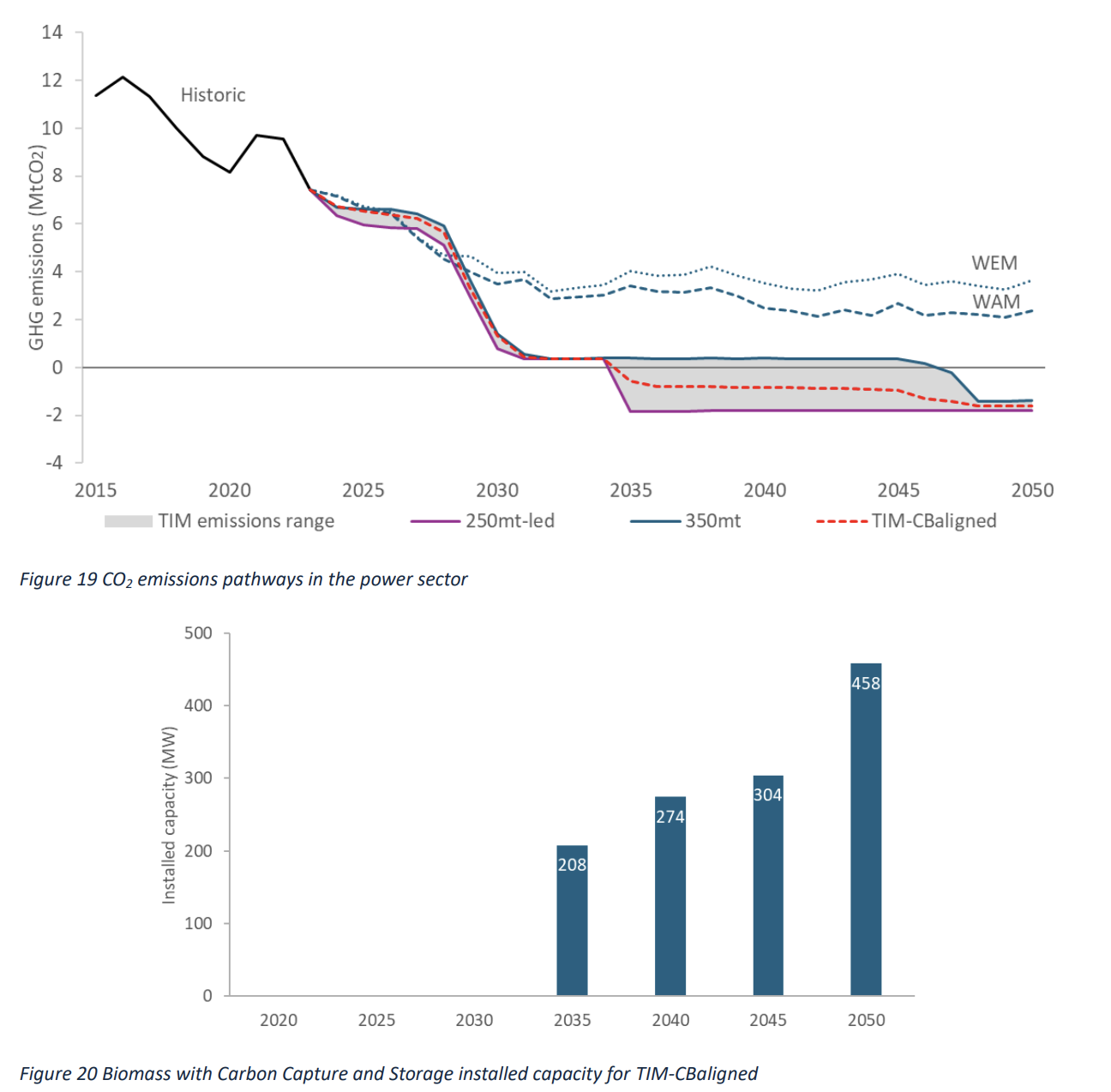

It’s worth noting that CCAC scenarios include some amount of BECCS (Bioenergy with Carbon Capture and Storage), a technology that is mostly speculative, by 2035, but it’s only a small fraction of power generation.

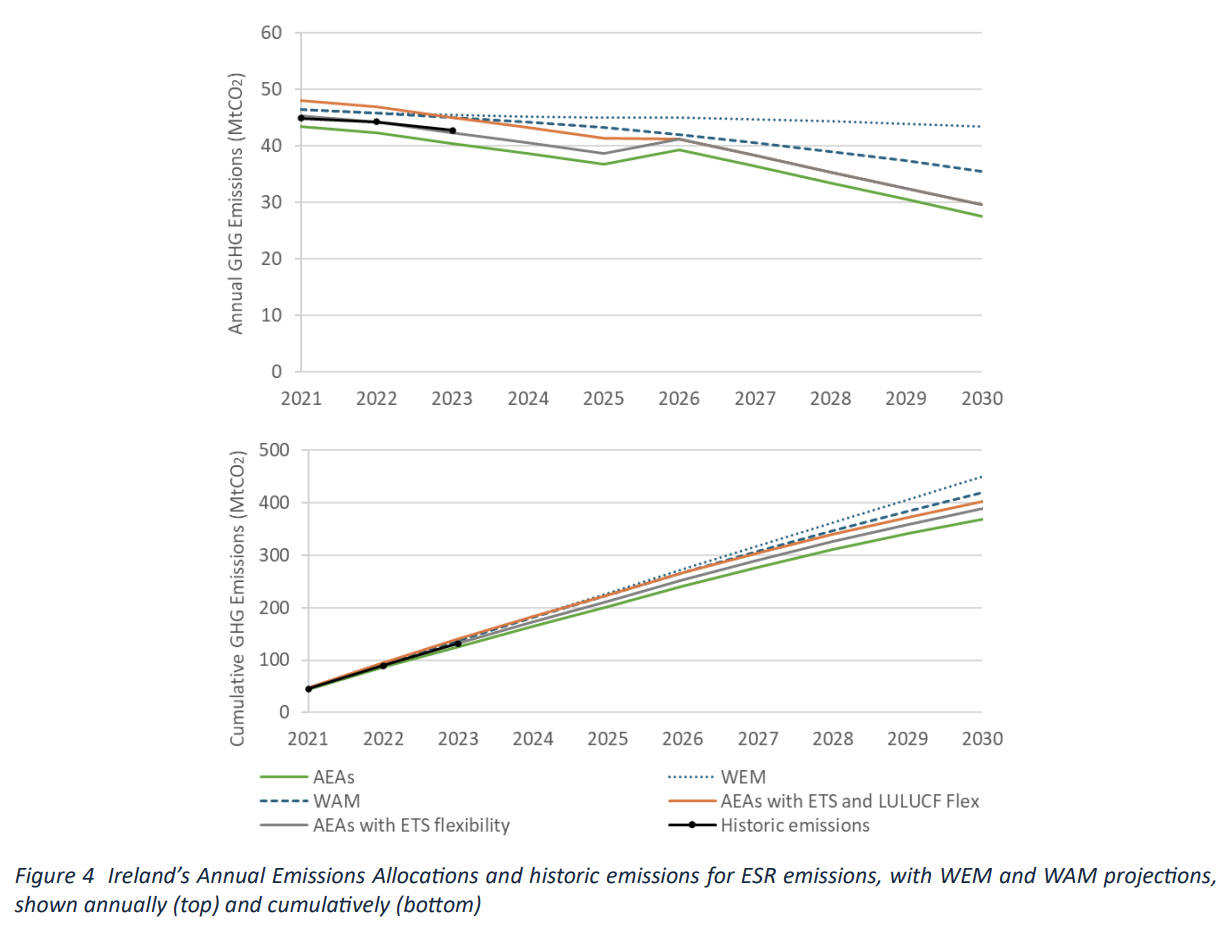

Effort Sharing Regulation (ESR): Includes agriculture, road transport, buildings, light industry and waste. Failing to meet Annual Emissions Allocations (AEAs) in any year results in a 1.08 equivalent AEA added to the next year. We can use up to 4% of our ETS allowance to offset AEAs in most scenarios. There’s also something about being able to use “Land Use, Land Use Change and Forestry” (LULCUF) credits for offset here but it seems like accounting rules are changing it’s unclear if there will be offsets available from this from after 2025.

We are going to fall well short of our ESR commitments. The target is a 42% GHG reduction compared to 2005 levels by 2030. WEM has us hitting 9%(!!!), WAM is 26%. The scenarios based on current and proposed carbon budgets are better, but still breach our commitments.

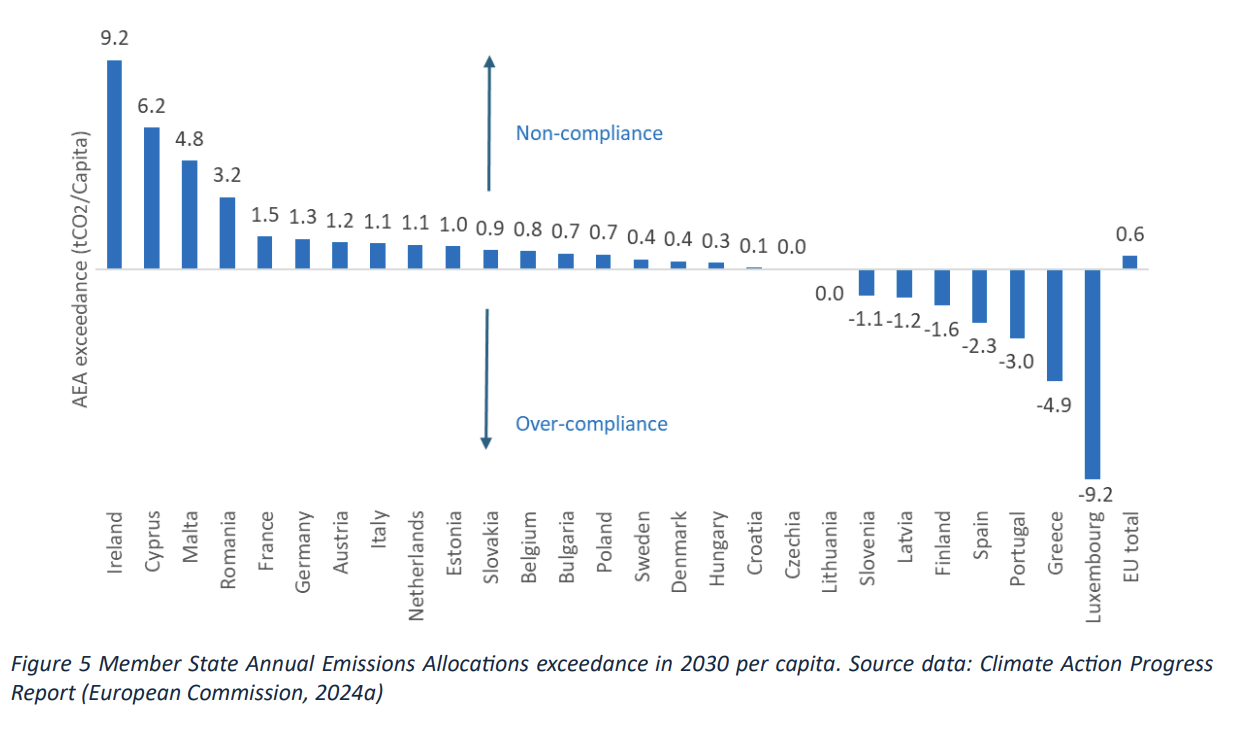

"To remain in compliance Ireland will either have to buy credits from other Member States who have over-performed against their AEAs or be faced with infringement fines for non-compliance." - this has gotten some play in the press and for good reason. Estimates are this could cost Ireland anywhere from €3-16 billion because based on this is looks like it’s going to be a seller’s market and we are going to be one of the most desperate buyers:

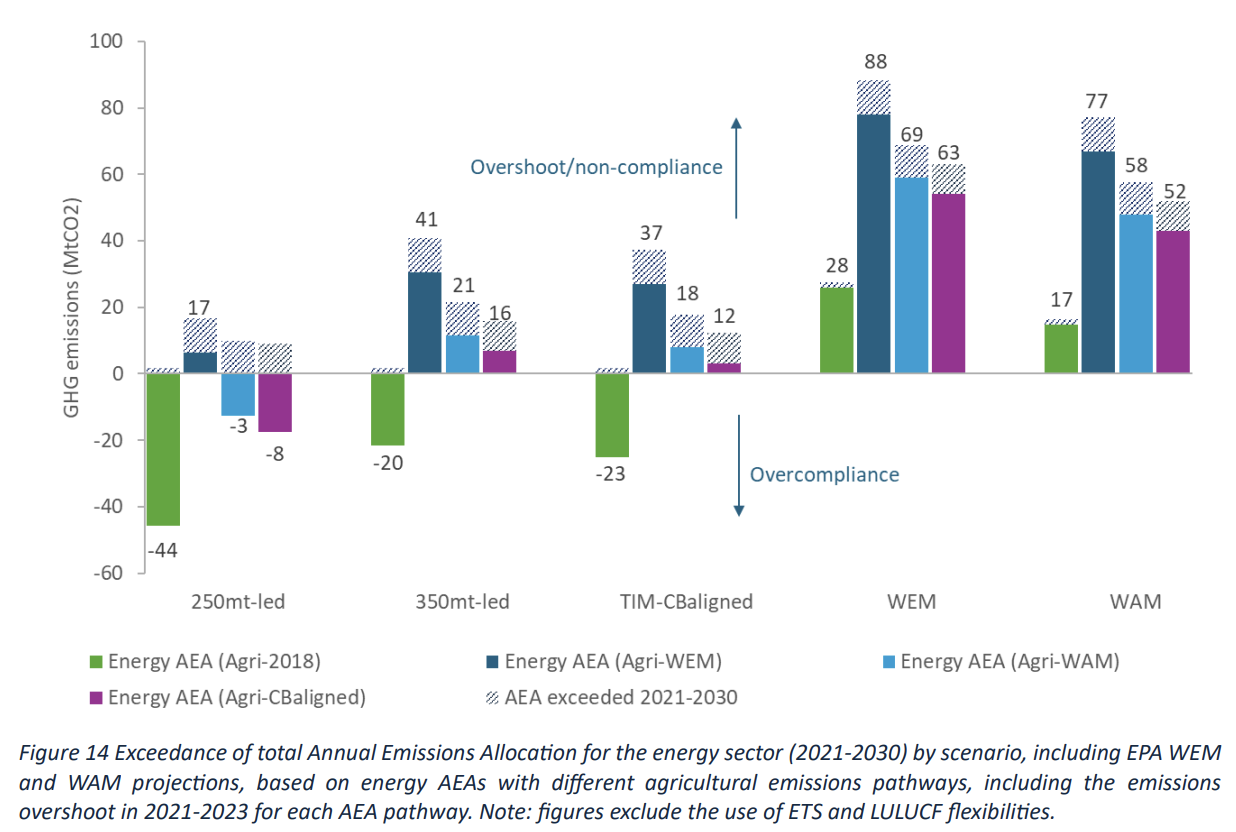

I think because agriculture has its own set of scenarios, the report does a somewhat complicated thing of showing how much the energy sector will overshoot/undershoot under different energy system scenarios and agriculture scenarios. Anyway, the answer is not good. There is basically one very ambitious/optimistic scenario where we keep below our targets. In the scenarios based on current and proposed carbon budgets we exceed our targets, and in the WEM/WAM scenarios we blow way way past them.

Also worth noting that cabon budget scenarios assume 100% CCS for cement manufacturing (again, an unproven technology).

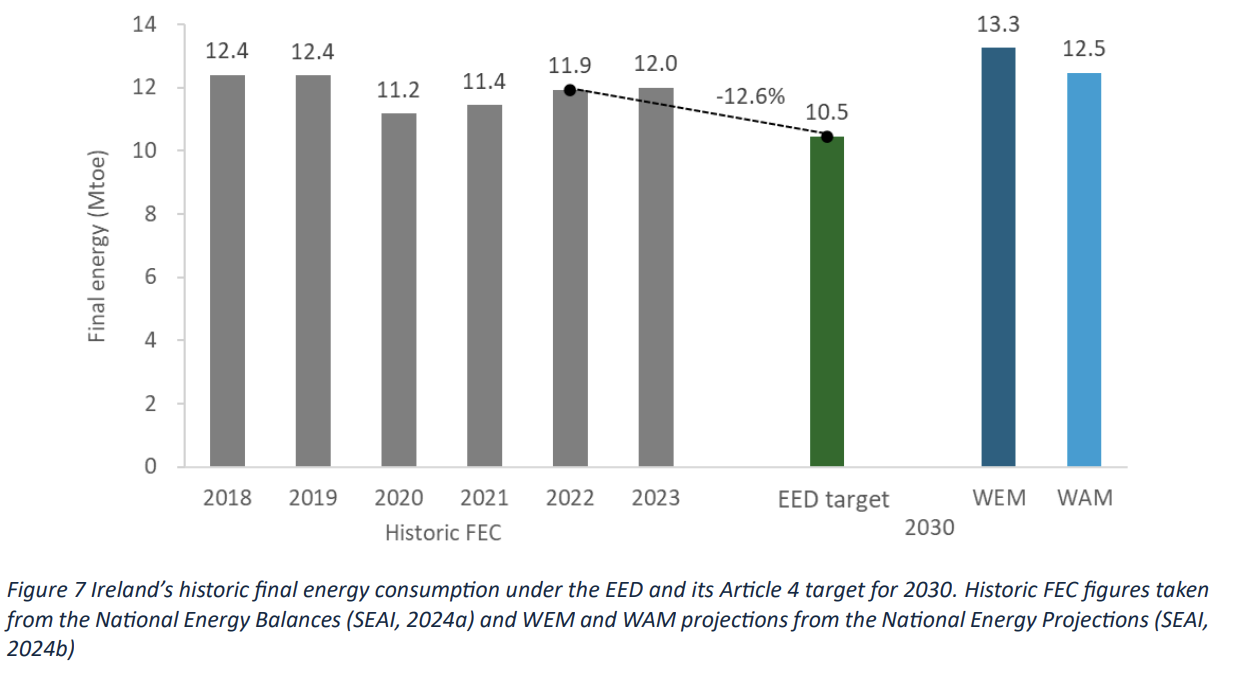

Energy Efficiency Directive (ESD): This is binding at the EU level but not at the country, even though there are country-specific targets (so no consequences for countries?). It’s about lowering final energy consumption (FEC). So there is a tension between increased efficiencies and increased demand. The Irish target for 2030 is a 12.6% reduction on 2022 levels.

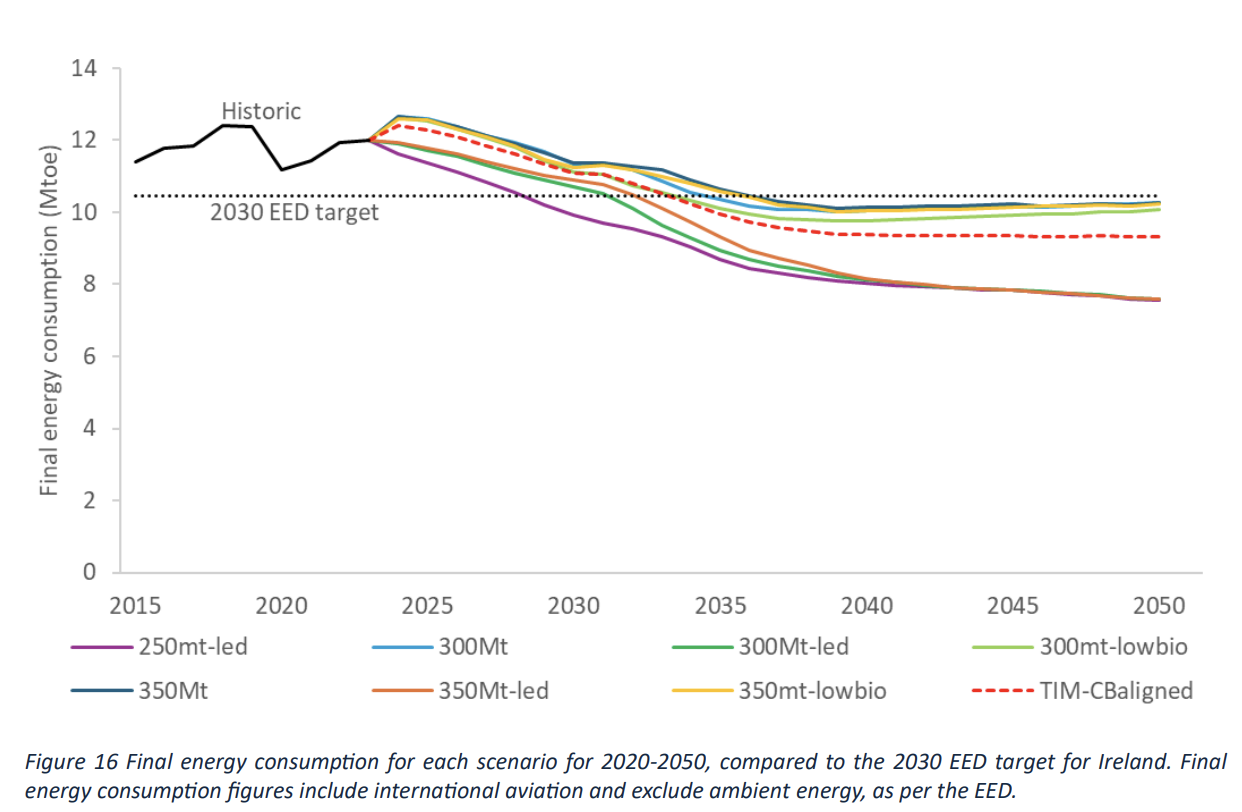

Under WEM/WAM scenarios, Ireland is likely to exceed the 2030 target by 20% -30%. Things look better for carbon budget scenarios though only the most aggressive (250mt-led) get us there in time

EU 2040: These are GHG budgets for 2030-2050 based on EU commitments from the Paris Agreements. Not formally adopted yet, but target guidance is a 90% reduction in GHG emissions by 2040.

Under WEM Ireland will only reduce GHG emissions by 12% by 2040, and 33% under WAM. CCAC proposals target up to 68% but we’re already not meeting our existing carbon budgets so that doesn’t seem likely unless things change.

Sectoral notes

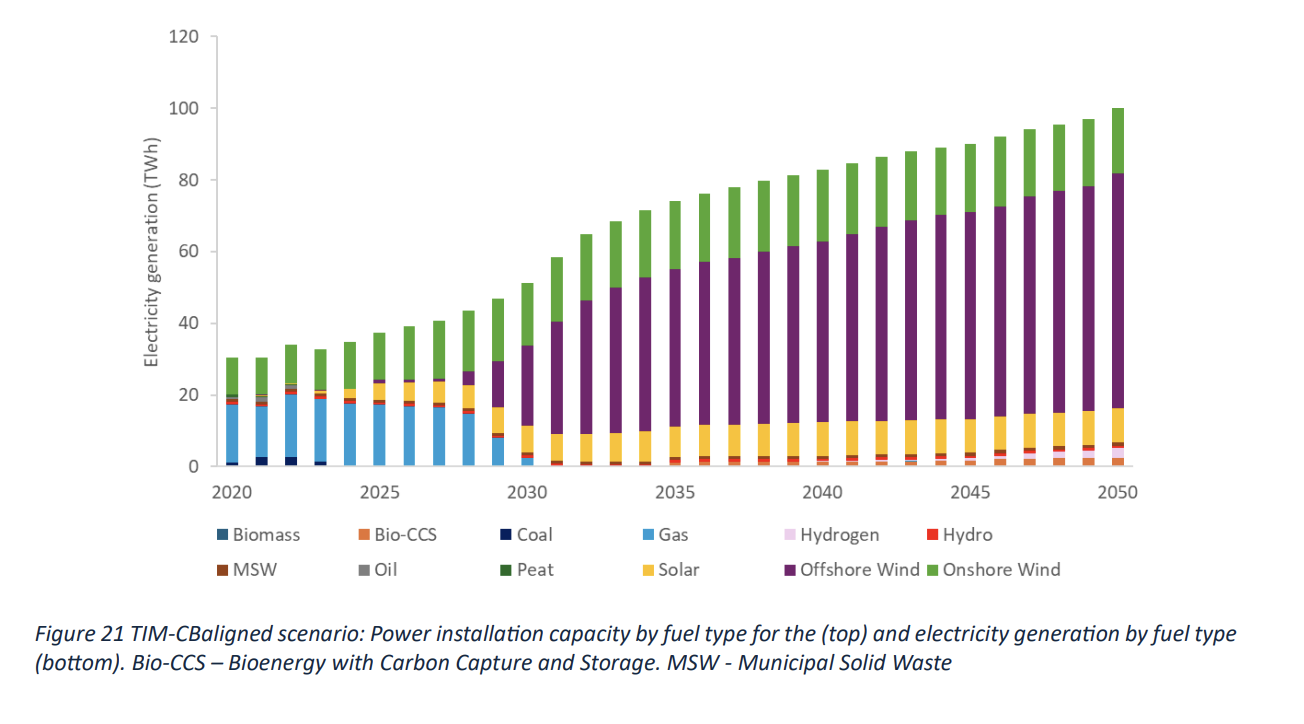

- The future of power generation is wind with a bit of solar:

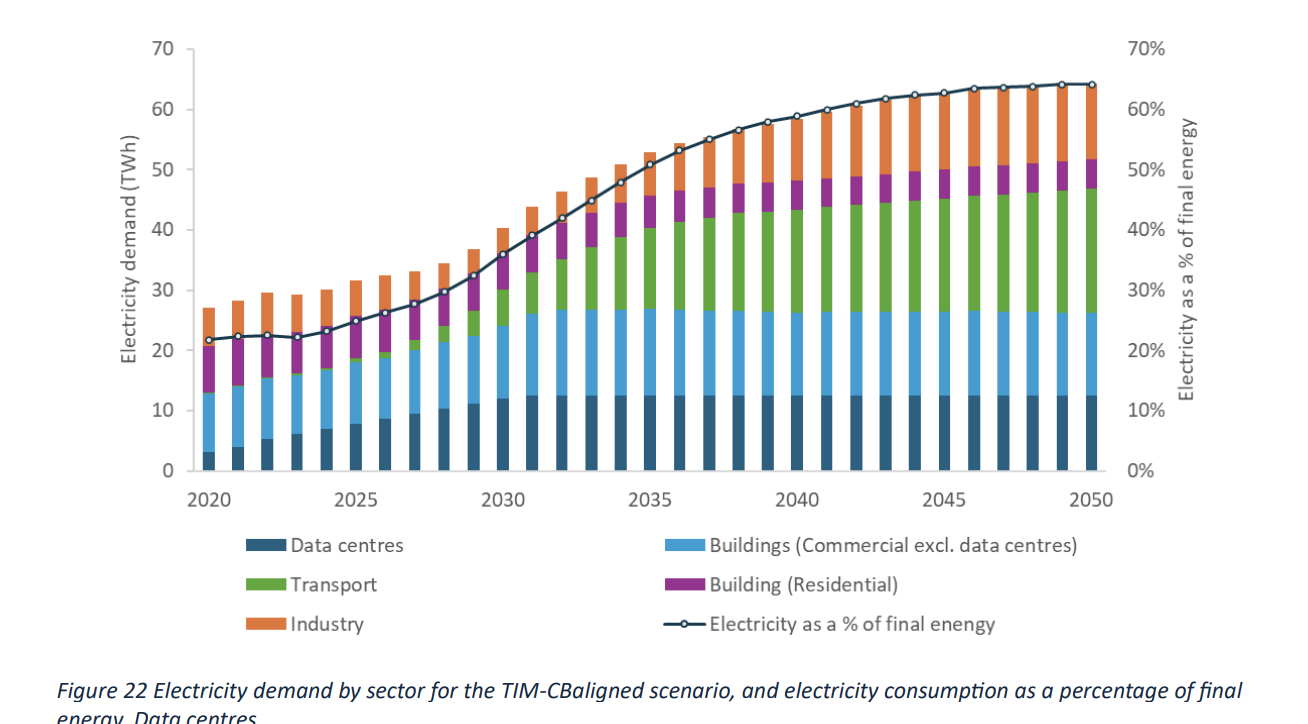

- Future demand growth will be driven by transport, DCs and industry in that order

- We might get significant district heating!

What does this mean?

Apart from the prospect of expensive fines and/or carbon credits when we fail to meet our EU commitments, and the general badness of pumping more GHGs into the atmosphere and making climate change that much worse, this sentence jumped out:

"failure to align national and EU targets represents a missed opportunity for economic and societal benefits that the transition to a low-carbon economy could bring."

I think this is a true and important point for motivation. The energy transition is not just something we have to do to mitigate the bad climate impacts that are coming, it’s also an opportunity that Ireland should be grasping with both hands.

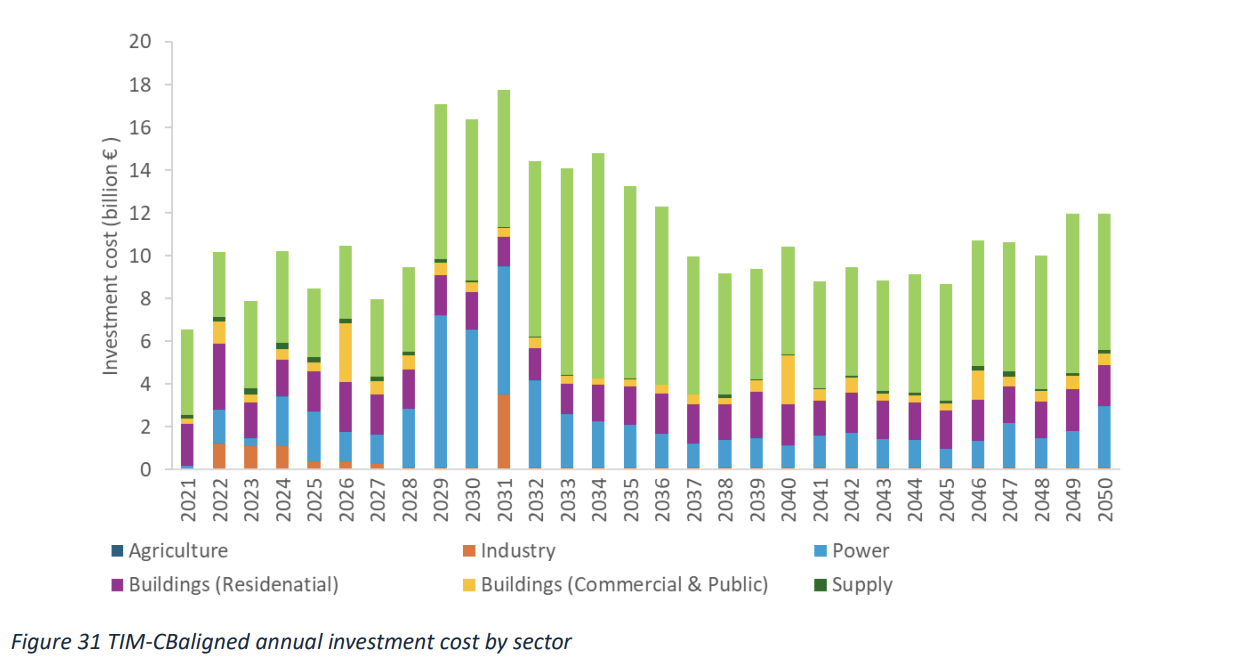

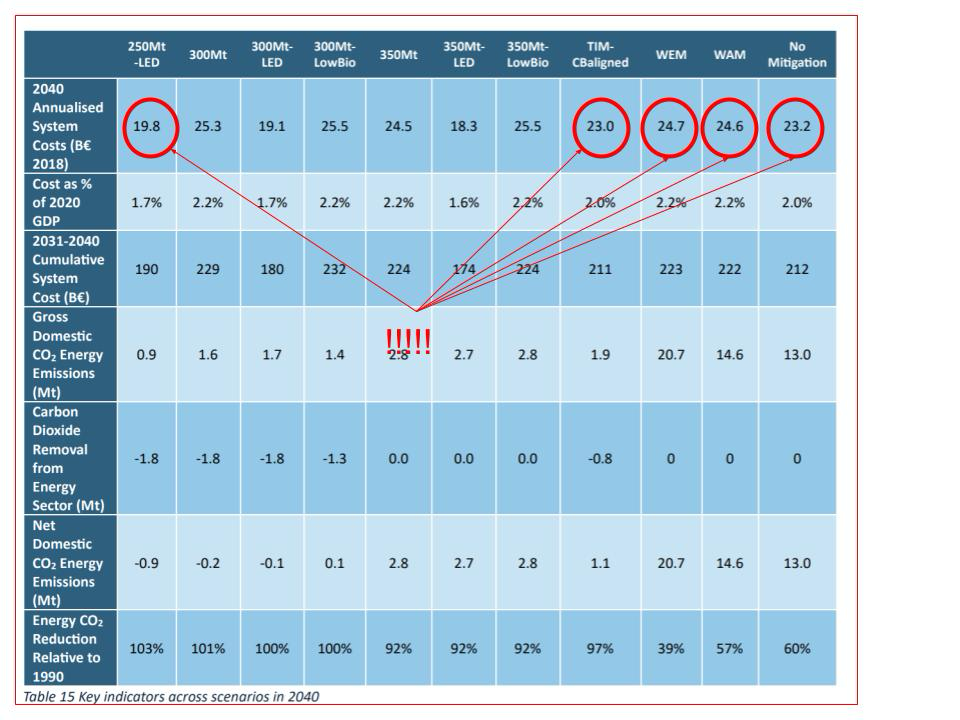

And if the above seems a bit wishy-washy, then look at this costing table that finishes out the report

That’s right, the annualised-cost for both the most aggressive GHG reduction plan, and the more modest blended plan are significantly cheaper than the EPA’s WEM/WAM projections, and even the “do nothing” option. This is because mitigation solutions cut fossil fuel costs. It’s the classic capex vs opex tradeoff seen across many renewable projects. And this doesn’t even account for the billions of euros of costs in breaching our commitments or the environmental, social and health benefits of GHG reductions.

Questions I have after reading the report

- What is the government’s plan in light of all of this? I have not heard anything but I assume/hope it is being taken seriously. Is anyone going to tackle the issue of agriculture emissions seriously?

- For ESR targets, “countries with a higher GDP per capita assigned more ambitious reduction targets.” - is Ireland being bitten by our artificially inflated GDP?

Notes

Glossary

- WEM: with existing measures

- WAM: with additional measures (as planned by the government)

- CCAC: climate change advisory council

- LULUCF: land use, land use change and forestry

- CB1, CB2: carbon budgets from 2021-2025 and 2026-2030

- AEA: annual emissions allocations

- FEC: final energy consumption

Background

- Agriculture and land use and forestry not included in this report.

- Goals

- Ireland is legally committed to reduce GHG emissions by 51%, relative to 2018, by 2030, and 100% (net) by 2050. (Mechanisms) The 1) carbon budgets and 2) sectoral emissions ceilings (SECs) are established in the “Climate Action and Low Carbon Development (Amendment) Act 2021”.

- Ireland’s carbon budgets are in law to 2030 and proposed (by CCAC) to 2040.

- Separately, Ireland has EU-wide commitments under the “Fit for 55” package, the Energy Efficiency Directive, and the EU Climate Law

- Carbon budgets and SECs are how we meet EU obligations, so they need to be aligned. We’re already off course on carbon budgets and SECs and so EU targets.

- Failure to meet EU targets fines and/or legal action. But also “failure to align national and EU targets represents a missed opportunity for economic and societal benefits that the transition to a low-carbon economy could bring.”

- Models used

- TIMES-Ireland Model (TIM), a least-cost energy systems optimisation model.

- TIM-CBaligned , A composite scenario averaging energy sectors and the scenarios used to inform the CCAC’s proposed third and fourth carbon budgets (2031–2040).

Commitments

- Carbon budgets and SECs

- The Climate Act requires the Climate Change Advisory Council (CCAC) to provide recommendations on five-year, economy-wide carbon budgets to Government.

- The Minister for the Environment, Climate and Communications to prepare the SECs for each sector, to be submitted to approval to the Government after carbon budgets are approved.

- Note the missing SEC for LULUCF, and the 26 MtCO2eq overshoot for 2026-2030.

- Compliance

- EPA says not on track (with WEM or WAM) to meet 1) 51% by 2030, carbon budgets or SECs.

- 64% of the first carbon budget has been used up in the first 3 years of the 5-year carbon budget period

- ==the cumulative overshoot under current projections exceeds the carbon budgets proposed for both CB3 and CB4.!!!

- EU commitments

- The European Green Deal:

- reduce emissions by 55% by 2030, compared to 1990 levels

- commits the EU to achieving net-zero GHG emissions by 2050

- Three key pieces of legislation

- Emissions Trading Scheme (ETS)

- Not country-specific

- Covers ~40% of total EU emissions.

- In Ireland, ~22% of emissions are covered because of large contributions of agriculture (38%) and transport (21%)

- Includes electricity and heat production, large scale industrial manufacturing, and ==intra-EU aviation

- Cap and trade where GHG cap is set per sector.

- Caps decrease annually aiming for 62% reduction relative to 2005 by 2030.

- Participants (companies?) much match emissions with credits annually, buying/selling as needed.

- Ireland per-capita emissions under ETS are below EU average mostly due to the low amount of heavy industry and renewable generation of power.

- Effort Sharing Regulation (ESR)

- Country-specific

- sectors not covered by the EU-ETS –including agriculture, road transport, buildings, light industry and waste (collectively referred to as ESR sectors), but excludes the LULUCF sector (these account for ~60 of EU GHG emissions)

- Goal is 40% cut relative to 2005 levels by 2030.

- Assigned reductions proportional to per-capita GDP. ==Oh is Ireland bitten by our fake GDP here?

- AEAs defined from 2021-25, decreasing every year. 2025-2030 to be decided this year based on 2021-2023 figures.

- Can bank/borrow/trade emissions (under certain conditions)

- Failing to meet AEA in any year even using above flexibilities results in 1.08 equivalent added to next year’s obligations.

- Ireland’s target is a 42% relative to 2005 GHG reduction by 2030.

- Flexibilities

- ETS: allows the use of ETS allowances to help offset emissions in ESR sectors, which would otherwise be auctioned. Ireland plans to use credits ~4% ESR emissions in 2005, or 1.91 MtCO2.

- LULUCF: based on credits from action undertaken in the LULUCF sector and is equivalent to 26.8 MtCO2eq from 2021-2030 for Ireland. However, there is a change in LULUCF accounting rules from 2026 which makes this uncertain so above graph only counts 2.68 MtCO2eq per year available up to 2025.

- Projected compliance

- Currently Ireland is projected to fall significantly short of the ESR targets.

- WEM: 9% fall in GHG emissions by 2030

- WAM: 26% fall by 2030

- Target: 42%

- ==To remain in compliance Ireland will either have to buy credits from other Member States who have over-performed against their AEAs or be faced with infringement fines for non-compliance.

- The exceedance is the largest across all EU Member States in terms of percentage points and the largest on a per-capita basis

- Energy Efficiency Directive (EED)

- Country specific, non-binding at country level, binding at EU level (==how does that work?)

- About lowering final energy consumption (FEC). So there is a tension between increased efficiencies and increased demand.

- Includes international aviation but not ambient energy (heat pumps)

- Target of limiting FEC in the EU in 2030 to 763 Mtoe, a 11.7% reduction compared to the 2030 final energy projections in the 2020 EU Reference Scenario.

- Irish target for 2030 of 10.451 Mtoe, a 12.6% reduction on 2022 levels (so more aggressive than EU target, but not binding. Are we just trying to look good?).

- Projected compliance

- Ireland not on track to meet the 2030 target. Will likely exceed the 2030 target by 20% -30%, with FEC in 2030 of 13.3 Mtoe for WEM, and 12.5 Mtoe for WAM.

- EU 2040

- Mandates GHG budgets for 2030-2050 compatible with EU Paris Agreement commitments.

- Not formally adopted or guidance available for states.

- Ireland’s predicted GHG reduction by 2040 is 12/33% for WEM/WAM vs 90% EU goal.

- EU summary table

Reality (and Predictions)

- Predictions based on scenarios used by CCAC in government recommendations in 2024.

- Carbon budget

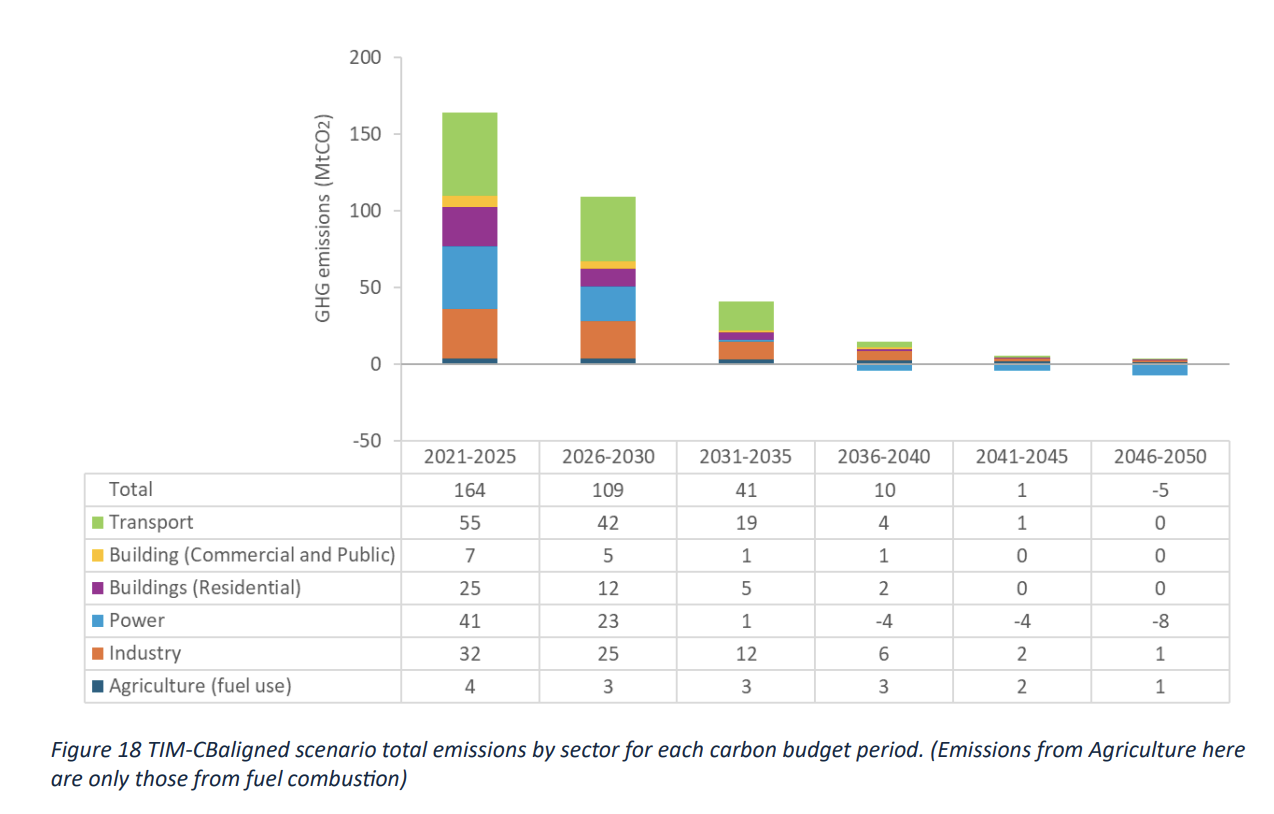

- Using TIM, models multiple potential pathways and covers fossil fuel combustion in power generation, buildings, transport and industry, and excluding emissions from international shipping and aviation.

- TIMCBaligned is a weighted average of the energy sector trajectories from the fifteen shortlisted scenarios used to determine carbon budgets 3 and 4 (2031–2040). Weighted according how frequently they appear in the 15 overall shortlisted scenarios

- EU Targets

- Focus on

- alignment of EU targets with TIM-CBaligned.

- How TIM-CBaligned matches WEM/WAM.

- ETS: process emissions (mostly from cement production) within the industry, energy emissions (manufacturing combustion), power generation emissions

- Target: 61%. All CB scenarios surpass the 2030 emissions reduction target. TIM-CBaligned achieves a 77% decrease. WEM just misses, WAM achieves a 67% reduction.

- Reductions largely driven by power sector 500% drop. Industrial combustion drops 100% and industrial processing is ~flat.

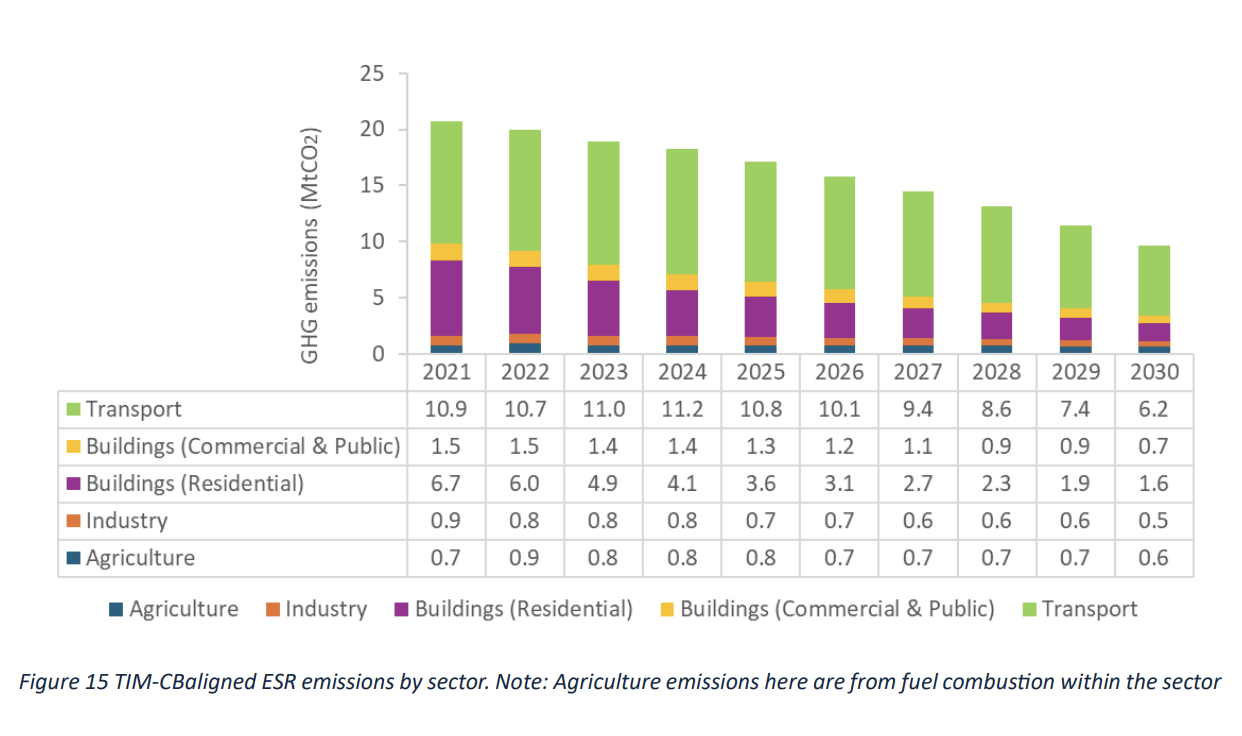

- ESR: energy emissions (manufacturing combustion), transport and buildings

- Ireland committed to 42% reduction relative to 2005 by 2030.

- No sectoral AEAs, but agriculture accounts for 38% of total GHG emissions (excluding LULUCF), and approximately half of ESR emissions, so let’s think about how much agriculture might leave for energy AEAs.

- This is a bit hard to read but it’s saying is that under the most ambitious carbon budget (250mt-led) almost all agricultural forecasts keep the energy AEA below it’s limit; for the least ambitious carbon budget (350m-led) and TIM-CBaligned, it only works for the most optimistic forecast (Agri-2018), and it’s a disaster for WEM/WAM.

- In theory, use of ETS flexibility (19.1 MtCO2) to meet Agri-WAM and Agri-WAM for TIM-CBaligned. There is also a possible LULUCF flexibility of 13.4MtCO2 but it’s not clear if that will be available. Even the combined use of both flexibilities (32.5 MtCO2 in total) would be insufficient in the Agri-WEM/Agri-WAM scenarios

- ESD

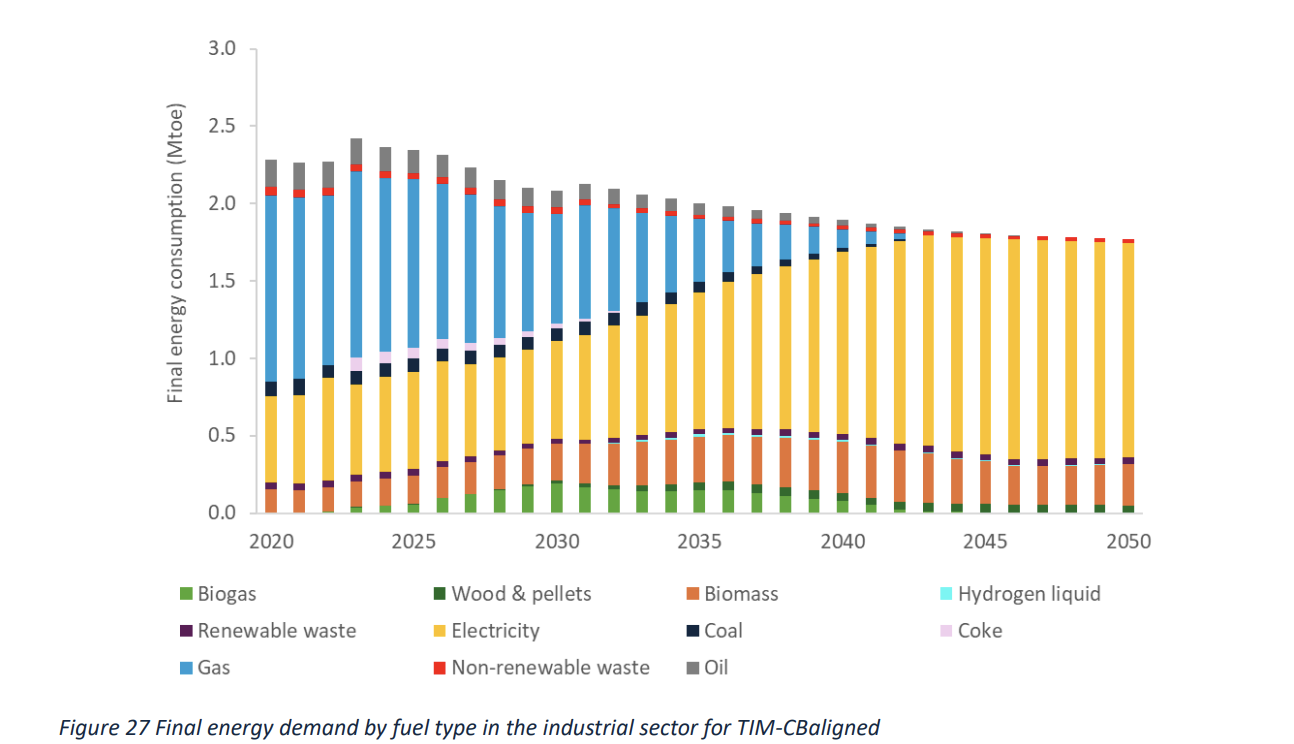

- Sub-sectoral emissions analysis

- All sectors for TIM-CBaligned (negative values are where we drop below the 1990 baseline)

- Power

- Ah, so we are assuming (a small amount) of BECCS for TIM-CBaligned

- Betting the farm on offshore wind

- Demand is way up driven by DCs, transport, and somewhat industry:

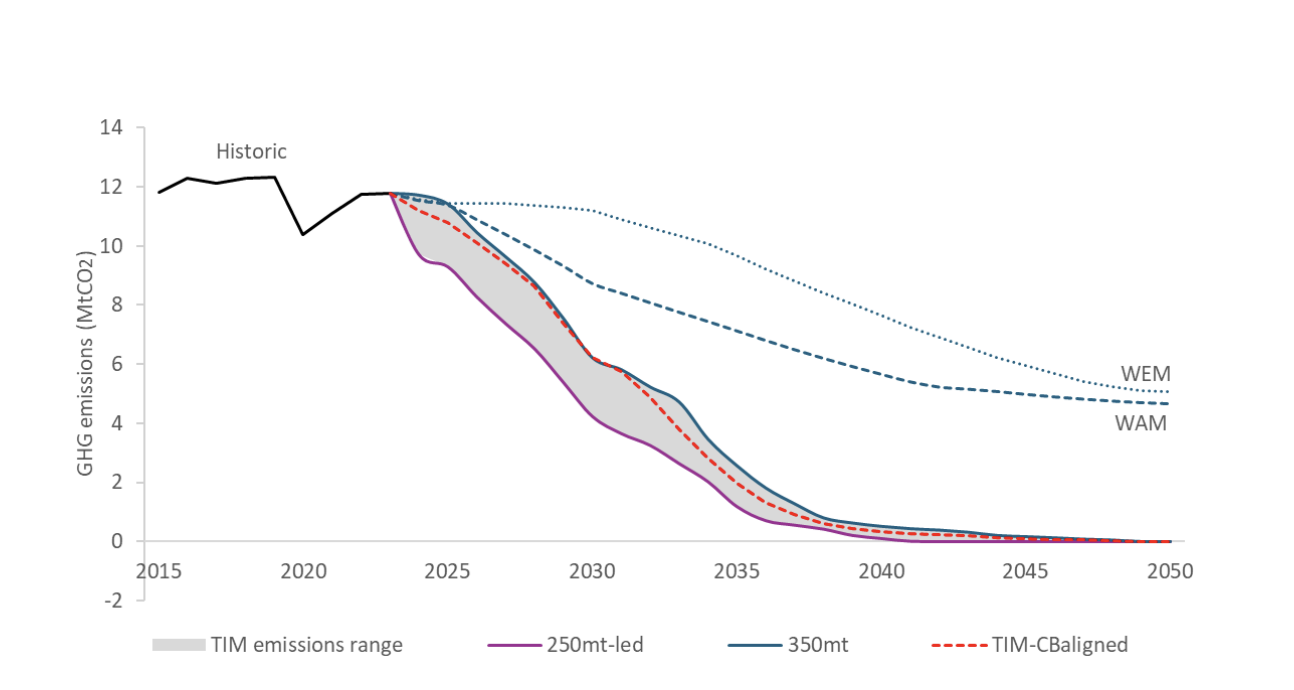

- Transport

- assumes the end of new internal combustion engines by 2025 for private vehicles and 2027 for freight vehicles. - legislation is currently for 2035

- Industry

- CCS assumed for cement manufacturing in all CB scenarios.

- Buildings

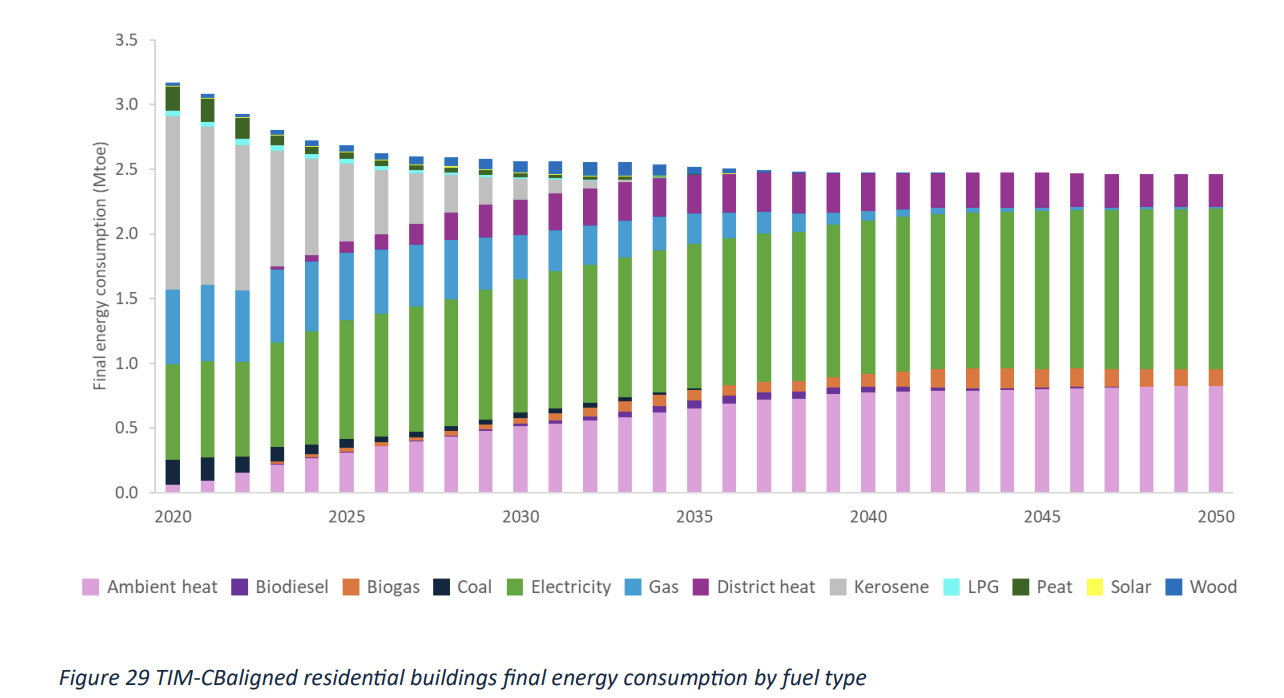

- District heating!

- Costs

- TIM-CBaligned costs are nearly identical to a “No Mitigation” scenario and are lower than WAM, because mitigation solutions cut the demand for expensive fossil fuels. The upfront investments are higher.

- €100 billion is required by 2030, increasing to €230 billion investment by 2040.